Simplifying UK Payroll The Right Software Choice

Simplifying UK Payroll The Right Software Choice

Running a business in the UK demands precision. Managing payroll is often complex. Every employer must comply with HMRC rules. Mistakes can be costly. This article explores payroll software UK. It highlights its vital role. We will discuss its benefits. We will also examine key features. Choosing the right payroll software UK is crucial. It ensures smooth operations. It also guarantees compliance.

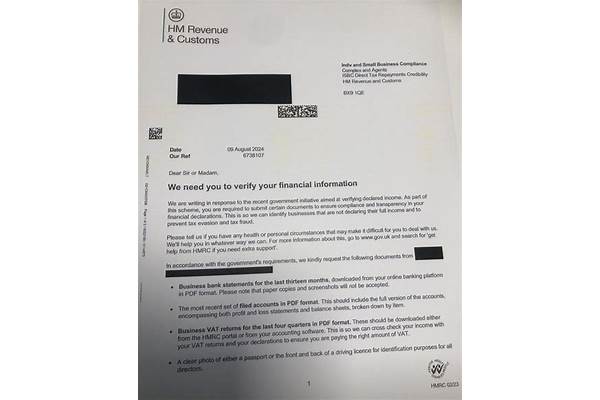

Understanding UK Payroll Complexities

UK payroll involves many moving parts. Employers handle PAYE tax. National Insurance contributions are mandatory. Pension auto-enrolment adds another layer. Statutory payments need careful calculation. This includes SSP, SMP, and SPP. Manual processes are prone to error. They consume valuable time. Keeping up with legislation is hard. HMRC updates rules regularly. Business owners face constant pressure. They seek reliable solutions. Payroll software UK offers this relief. It automates these intricate tasks. It ensures accuracy. It helps businesses stay compliant.

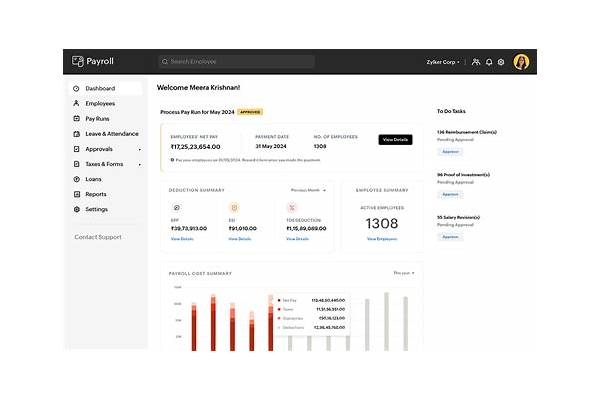

The Core Benefits of Modern Payroll Software UK

Modern payroll software UK transforms operations. It moves beyond basic calculations. It offers significant advantages. Automation is a primary benefit. It reduces manual data entry. This saves countless hours. Accuracy improves dramatically. The software calculates taxes precisely. It applies correct NI rates. This minimises costly errors. Compliance becomes effortless. The software updates with HMRC changes. It submits RTI data automatically. This avoids penalties. Data security is enhanced. Sensitive employee data is protected. Robust encryption is standard. Employee satisfaction can rise. Payslips are always accurate. They are delivered on time. Self-service portals empower staff. They can access their own information. This reduces HR queries. Overall efficiency sees a boost. Resources are freed for growth. Businesses focus on core activities.

Key Features Defining Excellent Payroll Software UK

Not all software is equal. Certain features are essential. Look for HMRC recognition. This ensures full compliance. RTI submissions must be seamless. Auto-enrolment integration is vital. It manages pension contributions. It handles employee communications. Excellent payroll software UK offers scalability. It grows with your business. Integration with other systems is key. Connect it with accounting software. Link it to HR platforms. This creates a unified system. Reporting capabilities are important. Generate detailed financial reports. Track payroll costs easily. User experience matters greatly. The interface should be intuitive. Training time will be minimal. Robust customer support is crucial. Help should be readily available. Choose a provider with a strong reputation. Check online reviews thoroughly. Ensure data backup features exist. This protects against data loss.

Real-World Impact: Sarah’s Bakery Story

Sarah owns a small bakery. She employed five staff members. Payroll was her biggest headache. Manual spreadsheets were slow. She often missed deadlines. HMRC fines became a concern. Sarah then sought payroll software UK. She chose a cloud-based solution. The change was immediate. Payroll took minutes, not hours. RTI submissions were automatic. Pension contributions were simple. Her staff received accurate payslips. Sarah felt less stressed. She spent more time baking. Her business thrived. This is a common story. Many businesses find similar relief. The right software truly helps.

Choosing Your Ideal Payroll Software UK

Selecting the best software requires thought. Start by assessing your business size. How many employees do you have? Consider your budget constraints. Software varies in price. Define your specific needs. Do you need advanced reporting? Is integration a priority? Research different providers. Compare their feature sets. Look for free trials. Test the software thoroughly. Speak to their sales teams. Ask about ongoing support. Consider long-term scalability. Your business will evolve. The software should adapt. [See also: A Comprehensive Guide to HR Software for SMEs]

Trends Shaping Future Payroll Software UK

The landscape is always changing. Technology drives innovation. AI and machine learning are emerging. They predict payroll needs. They identify potential errors. Automation will become deeper. Repetitive tasks will vanish. Employee self-service will expand. Staff manage their own data. They update details easily. Mobile access is growing. Payroll tasks on the go. Data analytics offers insights. Understand your labour costs better. Future payroll software UK will be smarter. It will be more integrated. It will be even more efficient. Stay updated with these trends. They will impact your operations.

Implementing New Payroll Software UK Successfully

Transitioning to new software needs planning. First, prepare your existing data. Ensure it is clean and accurate. Migrate data carefully. Follow the software provider’s guide. Train your team thoroughly. Familiarise them with the system. Designate a payroll champion. This person can offer support. Run parallel payrolls initially. Process old and new systems together. Compare results closely. This catches any discrepancies. Seek feedback from users. Address any issues promptly. Regularly review your settings. Ensure they meet current needs. Stay informed about updates. Software providers release new features. Legislative changes are frequent. Keep your system current. This ensures continued compliance. It maximises your investment.

Conclusion: Embracing the Future of UK Payroll

Payroll management is fundamental. It impacts every business. The complexities of UK regulations are real. Manual processes are simply unsustainable. Payroll software UK offers a clear path forward. It delivers accuracy and efficiency. It ensures robust compliance. It frees up valuable resources. Sarah’s bakery story is one example. Countless businesses benefit daily. Embrace the power of technology. Invest in the right solution. Your business will thrive. Your employees will be happier. Your compliance worries will diminish. The future of UK payroll is digital. Make sure your business is ready.