Your Guide to Seamless PAYE Software UK Payroll Management

Your Guide to Seamless PAYE Software UK Payroll Management

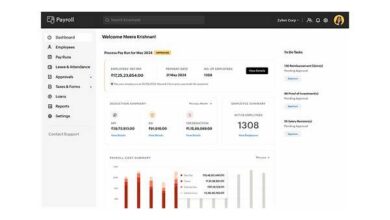

Running a business in the UK involves many tasks. Payroll management is crucial. It ensures employees are paid correctly. It also guarantees tax compliance. For many, this process feels complex. It often consumes valuable time. This is where PAYE software UK becomes indispensable. It transforms payroll operations. This article explores its critical role. We will discuss its benefits. We will also cover how to choose the best solution. Understanding PAYE software UK is key. It helps your business thrive.

Understanding PAYE Software UK Its Essential Context

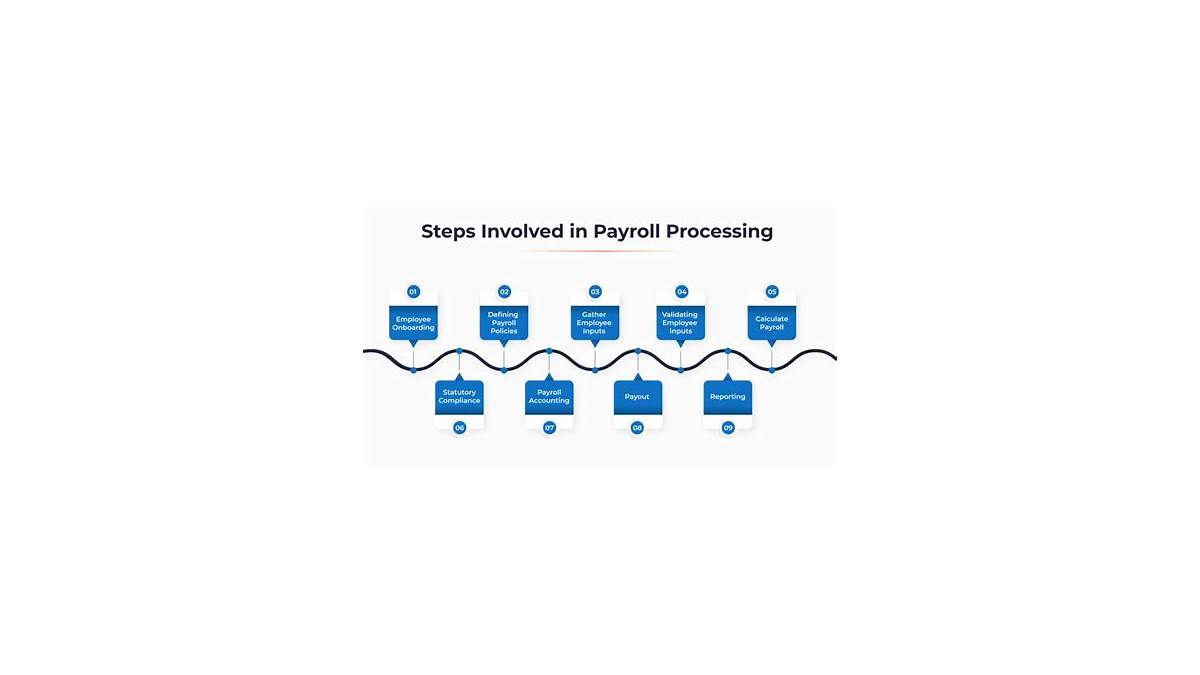

PAYE stands for Pay As You Earn. It is the system HMRC uses. It collects Income Tax. It also collects National Insurance. This happens from employment earnings. All UK employers must operate PAYE. This applies to most employees. Manual payroll can be challenging. It is prone to human error. Mistakes lead to penalties. HMRC rules frequently change. Keeping up is a full-time job. This complexity created a need. Businesses required robust tools. Enter the world of PAYE software UK. It simplifies this vital function.

Historically, payroll was manual. Accountants used ledger books. Calculations were lengthy. Submissions were paper-based. The digital age changed everything. HMRC introduced Real Time Information (RTI). Employers now report payroll data. They do this on or before payday. RTI compliance is mandatory. Modern PAYE software UK handles this. It automates crucial submissions. This ensures businesses stay compliant. It removes significant administrative burden. Many companies rely on it daily.

The Core Benefits of Dedicated PAYE Software UK Solutions

Investing in good PAYE software UK offers huge advantages. It goes beyond basic calculations. It provides a comprehensive solution. This supports your entire payroll cycle. Let’s explore its primary benefits.

Automated Calculations and Accuracy

Manual calculations are risky. They are time-consuming. PAYE software UK eliminates these issues. It automatically calculates tax. It handles National Insurance. It manages student loan deductions. It also processes pension contributions. This includes auto-enrolment. Accuracy is vastly improved. Errors become very rare. This saves money on potential fines. It builds employee trust. Correct paychecks are vital.

Simplified HMRC Submissions

HMRC requires timely data. Full Payment Submissions (FPS) are key. Employer Payment Summaries (EPS) are also needed. PAYE software UK automates these. It sends data directly to HMRC. This happens with a few clicks. It ensures strict RTI compliance. Deadlines are easily met. This dramatically reduces stress. Businesses can focus elsewhere. [See also: Navigating HMRC Compliance for Small Businesses]

Comprehensive Reporting Capabilities

Detailed reports are essential. They aid financial planning. They support internal audits. Good PAYE software UK generates these. You get payroll summaries. You see tax liability reports. Employee pay histories are available. This data helps strategic decisions. It provides a clear financial picture. Strong reporting is a hallmark. It defines reliable PAYE software UK.

Enhanced Data Security and Compliance

Payroll data is sensitive. It contains personal information. Security is paramount. Reputable PAYE software UK offers strong encryption. It includes robust access controls. This protects your data. It also helps with GDPR compliance. Data breaches are costly. Secure software is a preventative measure. It safeguards your business’s reputation.

Seamless Integration and Scalability

Many businesses use other systems. Accounting software is common. HR platforms are also popular. Leading PAYE software UK integrates easily. This creates a unified system. It avoids data duplication. It streamlines workflows. As your business grows, your needs change. Good software scales with you. It supports more employees. It handles increased complexity. This ensures long-term suitability.

Choosing the Right PAYE Software UK for Your Business

Selecting the ideal PAYE software UK requires careful thought. Many options exist. Each offers different features. Consider your unique business needs. This will guide your decision.

Assess Your Business Size and Needs

Are you a small startup? Do you have many employees? Small businesses might need basic features. Larger companies require more advanced functions. This includes departmental reporting. Consider your budget too. Different software caters to different scales. Define your specific requirements first.

Cloud-Based vs. Desktop Solutions

Cloud-based PAYE software UK offers flexibility. Access it anywhere. It requires an internet connection. Updates are automatic. Desktop software is installed locally. It might offer more control. It can be more secure for some. Consider your team’s working style. Think about data access preferences. Cloud solutions are increasingly popular.

Features and Functionality

Beyond core PAYE, what else do you need? Do you require pension auto-enrolment integration? What about employee self-service portals? Do you need holiday tracking? Look for features that add value. Ensure the software supports your specific industry. Check for customisation options. These can be very helpful.

Support and Training

New software always has a learning curve. Good customer support is vital. Check their availability. Look at their response times. Does the provider offer training? Are there online resources? Reliable support ensures smooth operation. It helps resolve issues quickly.

Practical Steps for Implementing New PAYE Software UK

Transitioning to new PAYE software UK can seem daunting. With proper planning, it is straightforward. Follow these practical steps for a smooth rollout.

- Define Your Requirements Clearly: Before anything else, list what you need. What features are essential? What are your must-haves? This prevents wasted time. It narrows down choices.

- Research and Compare Options: Explore various providers. Read reviews. Look at pricing structures. Compare feature sets. Most offer free trials. Take advantage of these.

- Plan Your Data Migration: Moving existing payroll data is crucial. Ensure accuracy during transfer. Most software offers migration tools. Follow their guidelines carefully.

- Train Your Team Thoroughly: Invest time in staff training. Ensure they understand the new system. Provide clear instructions. Address any questions or concerns.

- Run Parallel Payrolls (Initially): For a short period, run both systems. Process payroll with old and new software. Compare results. This identifies discrepancies early.

- Stay Updated with Software Releases: Payroll regulations change. Software updates are frequent. Install these promptly. They ensure continued compliance.

- Seek Expert Advice if Needed: If unsure, consult an expert. A payroll consultant can help. They can guide your selection. They can assist with implementation.

The Future of Payroll with Advanced PAYE Software UK

The landscape of payroll is always evolving. Technological advancements drive this change. Predictive analytics are emerging. AI-powered tools are on the horizon. These will further streamline processes. They will offer deeper insights. Mobile access is already common. It provides flexibility for managers. It empowers employees with self-service. The best PAYE software UK solutions embrace these trends. They continuously innovate. They adapt to new demands. This ensures businesses remain efficient. They stay compliant in a dynamic environment.

Data security will remain a top priority. As cyber threats evolve, so must protection. Advanced encryption and multi-factor authentication will be standard. Cloud infrastructure will continue to dominate. It offers unparalleled scalability. It provides robust disaster recovery. Businesses adopting cutting-edge PAYE software UK will gain a significant competitive edge. They will attract and retain talent. Efficient payroll is a foundation for growth. It supports a happy workforce. [See also: The Rise of Cloud-Based Payroll Systems]

Conclusion A Smarter Approach with PAYE Software UK

Managing payroll effectively is non-negotiable. It impacts every aspect of your business. From employee morale to regulatory compliance, its importance cannot be overstated. Manual methods are now outdated. They are inefficient. They carry too much risk. Embracing dedicated PAYE software UK is no longer optional. It is a strategic imperative. It frees up valuable time. It reduces human error. It guarantees compliance with HMRC rules. It strengthens your business foundation. Choose wisely. Implement thoughtfully. Empower your business. Secure its future with the right PAYE software UK solution. Your employees and your bottom line will thank you.